The performance of Chinese heavy-duty truck market in May

How was the heavy-duty truck market in May? People must wonder whether it was able to break through 110,000 units, equal to the performance made during the same period of last year or even increasing compared.

The ups and downs of the heavy truck market are really a "sucking belly". First, the performance in March, the convenient peak season, broke records with nearly 150,000 units. And then, the market turned from positive state to negative. In April, it decreased by 3% compared with year-on-year dates. In May, can the market thrive again, from negative to positive?

We have to say it is not easy to reach.

According to the latest data from the first commercial vehicle network, in May 2019, China's heavy truck market sold a total of 109,000 units of various types, a decrease of 8% from April this year and a 4% decrease from 114,000 units in the same period of last year.

Heavy truck market sales chart for 2014-2019

Why did the heavy truck market in May fall again year on year? In June, what will happen to the industry trend?

Heavy trucks fell by 4% year-on-year in May; the overall market demand is sluggish

In this May, the heavy truck market is expected to sell out 109,000 units, down 9% from the previous month and down 4% compared with the same period of last year. It failed to surpass the 113,300 units during the same period of last year and to set a record high in May. After the end of May, the average monthly sales volume of the heavy truck market from January to May 2019 was 110,600 units, down 1% from 112,000 units of the same period of last year.

The first commercial vehicle network believes that the heavy truck market has several characteristics in May according to their analysis dates. First, the heavy duty truck market for natural gas is still hot. Under the pull of this segment, the overall market of heavy trucks has not fallen sharply. This is mainly due to the advance purchase of dealers and users brought by the National Sixth Emission Standard for heavy-duty gas vehicles to be implemented from July 1. Second, the growth of some segments such as gas vehicles failed to cover the decline in overall market demand. In fact, since the beginning of the spring, due to the recovery of fixed asset investment and manufacturing industry failed to meet expectations, the terminal demand performance of the heavy truck market has always been unsatisfactory. This also directly led to a quick decline in the heavy truck market in April after a record high in March this year. The sales volume of April fell by 3% in comparison with that of March. In May, the market continued to decline. That is the third year-on-year decline month in heavy duty truck industry this year (January, April and May).

FAW growth exceeds 20%, while Dongfeng, CAMC and Dayun is growing

In May, the heavy truck market fell by 4% year-on-year. From the perspective of cumulative sales, the heavy truck industry sold a total of 553,400 units from January to May, down 1% in comparison with the 560,000 units in the same period of last year.

At the same time, there were some changes in the heavy truck market in May. FAW was the only company that maintained double-digit growth. The other three companies (Dongfeng, Dayun, CAMC) maintained a small increase; The sales of the remaining six companies have declined in varying degrees.

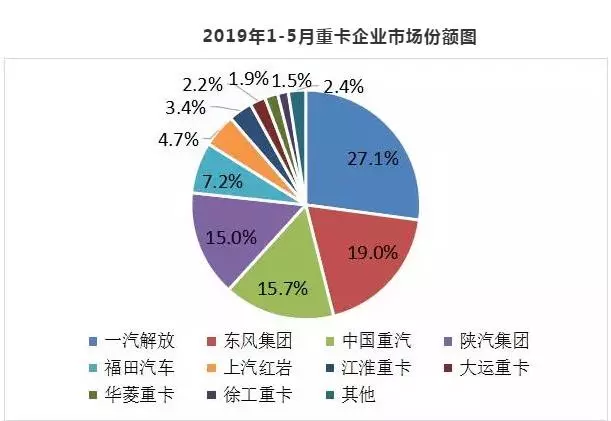

Specifically, FAW Jiefang continued to maintain its position as the industry leader. In May, it sold nearly 30,000 heavy-duty trucks, up 25% year-on-year. In the first five months of this year, the cumulative sales of heavy trucks exceeded 150,000, an increase of 9% year-on-year and a market share of 27.1%, which continue to rank in the industry sales champion. In 2019, FAW has been the first for the fourth consecutive year to maintain the first position of heavy trucks and medium and heavy trucks.

The second Dongfeng further stabilized top-two position in the industry. In April, Dongfeng sold 25,000 heavy trucks. In May, Dongfeng Heavy Trucks maintained its second place with a monthly sales volume of 22,000 units, up by 2% year-on-year. In the first five months of this year, Dongfeng Heavy Trucks sold a total of 104,900 units. The year-on-year growth rate was 5%, the market share increased to 19%, and the market ranking was also solid second in the industry.

Sinotruk sold 16,000 heavy trucks in May, with a cumulative sales volume of 86,600 units in the first five months of this year, and a market share of 15.7%. Shacman sold about 16,000 heavy trucks in May. The cumulative sales in the first five months of this year were 82,700 units, a year-on-year increase of 2%, and the market share was 15%. This company’s performance in the natural gas heavy duty truck segment in May was especially protruding.

Foton Motor sold more than 8,200 heavy trucks in May, with a cumulative sales volume of 40,000 units from January to May, and holding a market share of 7.2%.

Heavy truck business market share chart for January-May 2019

SAIC Hongyan jumped to the fifth place in the heavy truck market in January this year with sales volume of 6,517 units. In February, SAIC Hongyan sold 3,020 heavy trucks, ranking the sixth in the industry; in May and April, it was 5530 units and 6,150 units respectively. The monthly sales volume continued to be sixth; its sales volume of heavy trucks in May was about 5,000 units, with a cumulative sales volume of 26,200 units in the first five months, with a market share of 4.7%, which consistently maintained the top six in the industry. JAC Heavy Truck sold about 3,600 units in May this year, with a cumulative sales volume of 18,600 units from January to May, and an industry share of 3.4%.

In May, Dayun Motor sold 2,389 heavy trucks, up 1% year-on-year; cumulative sales of heavy trucks in January-May were 12,151 units, up 1% year-on-year, with a market share of 2.2%, maintaining the top eight in the industry. CAMC sold 2068 vehicles in May, and accumulated sales of 10269 units in January-May, up 3% year-on-year, with a market share of 1.9%. In recent years, XCMG has been ranked among the top ten in the industry, sold 2019 vehicles in May. In the first five months of this year, it sold 8355 units, an increase of 11% year-on-year and an industry share of 1.5%.

In May, sales volume of heavy truck industry declined slightly year-on-year. The cumulative year-on-year decline in the market from January to May this year continued to expand, and the declining tendency in heavy truck market was unstoppable. According to the latest data released by the National Bureau of Statistics, China's manufacturing purchasing managers' index (PMI) in May was 49.4%, which was below the glory line, down by 0.7 percentage points from the previous month and lower than 49.9% of the market expectation. This means that the downward pressure on the economy has increased and the development of the manufacturing industry is still weak. According to the analysis of the first commercial vehicle network, the sales volume of the heavy truck industry in June is also difficult to maintain growth (Wholesale sales of the gas heavy duty trucks segment in June will also be lower than May), heavy truck production and sales will enter a period of continuous decline.