Heavy truck sales surpassed 120,000 in April yet showed a decline

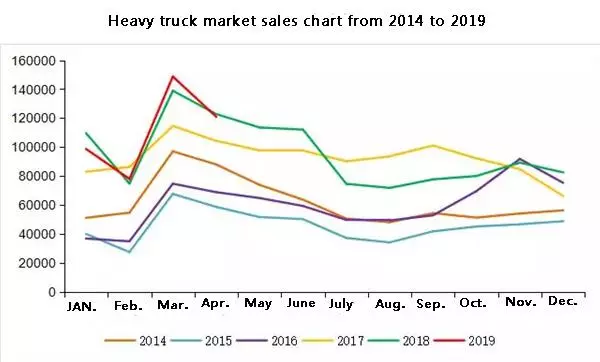

According to the latest data provided by cvworld.cn, in April 2019, China's heavy truck market sold about 121,000 vehicles of various types, down 19% from March this year, and 1% from the same period last year (122,800 vehicles).

Why was there a year-on-year decline in the heavy truck market in April? And in the next five or six months, how will the industry develop?

The heavy truck market in April showed a slight decline

In April this year, the heavy truck market was expected to sell 121,000 vehicles, down 19% from the previous month and slightly down 1% from last April, failing to surpass the record-high 122,800 vehicles in the same period last year. The average monthly sales volume of the heavy truck market reached 116,600 vehicles in the first four months of 2019, basically unchanged from 115,500 vehicles in the same period of last year.

cvworld.cn concludes that there are several reasons why the heavy truck market in April failed to maintain year-on-year growth. First of all, some enterprises got off to a flying start in March, with relatively high wholesale volumes. To some extent, they occupied the heavy truck market in April ahead of schedule. Secondly, the logistics vehicle terminal market performance was not satisfactory, the industry inventory was high, which had brought great pressure to the market and enterprises, letting the heavy truck market sales in April fail to maintain the trend of sustained growth.

The sales during the first four months were basically flat. The growth rates of FAW, Dongfeng, Shacman, XCMG were high.

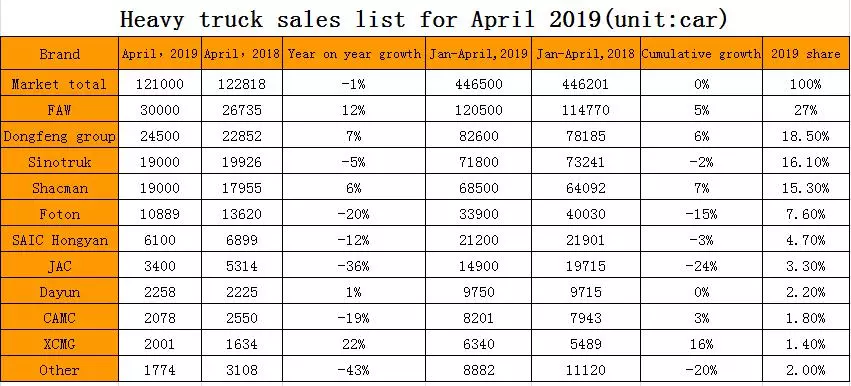

In April, the heavy truck market dropped by 1% year on year. From the perspective of cumulative sales, the heavy truck industry sold a total of 446,500 vehicles from January to April, basically unchanged from 446,200 vehicles in the same period of last year.

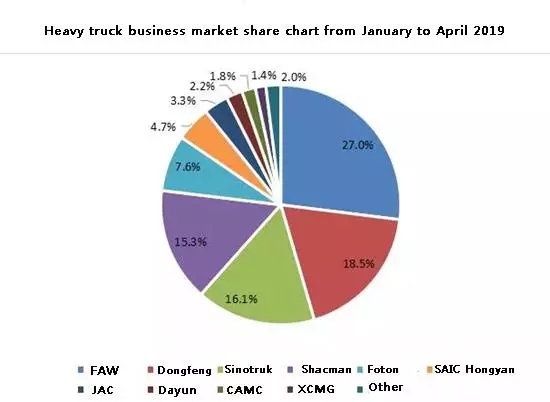

At the same time, the heavy truck market pattern in April basically maintained the development trend since March. First, FAW continued to maintain its position as the industry leader, selling 30,000 heavy trucks in April, up 12% year-on-year. In the first four months of this year, the accumulative sales of heavy trucks exceeded 120,000, with a year-on-year growth of 5% and a market share of 27%, ranking the top in the industry. So far, FAW, has maintained the first position in the Chinese heavy truck market, as well as the medium duty truck market for four years in a row (including 2019), which is still unshakeable.

Second, the runner-up in the industry, Dongfeng, further consolidated the top two positions with FAW. It is well known that in March, Dongfeng heavy truck sales overtook Sinotruk to regain second place in monthly sales volume and cumulative sales in the first quarter. In April, Dongfeng heavy truck sold 24,500 vehicles a month, firmly occupying the second place in the list. In the first four months of this year, Dongfeng heavy truck has sold 82,600 units, up 6% year-on-year, and its market share has increased to 18.5%, ranking the second in the industry.

Sinotruk sold 19,000 trucks in April and 71,800 in the first four months of this year, with a market share of 16.1%. In the first four months of this year, the total sales volume reached 68,500, up 7% year on year, and the market share was 15.3%, maintaining a stable position in the top four list of the industry. Foton sold nearly 11,000 heavy trucks in April and 33,900 in the first four months of this year, accounting for 7.6% of the market.

SAIC Hongyan jumped to fifth place in the heavy truck market in January with sales of 6,517 vehicles. In February, SAIC Hongyan sold 3,020 heavy trucks, ranking the sixth in the industry. In March, with the monthly sales volume of 5,530 vehicles, it continued to maintain sixth place. It sold about 6,100 heavy trucks in April, with a cumulative sales of 21,200 vehicles in the first four months, accounting for a market share of 4.7%, which has maintained a stable position in the top six list of the industry.

In April, 2,258 Dayun heavy trucks were sold, and in the first four months of this year, 9,750 heavy trucks were sold, almost unchanged year-on-year, with a market share of 2.2%. CAMC heavy truck sold 2,078 units in April and 8,201 units in the first four months of this year, up 3% year-on-year, with a market share of 1.8%. In recent years, XCMG heavy truck, which has always been in the top ten in the industry, sold 2001 vehicles in April, up 22% year on year. In the first four months of this year, it sold 6340 vehicles, up 16% year on year, accounting for 1.4% of the industry.

In April, the heavy truck market slightly decreased by 1% year on year. The accumulative sales volume from January to April this year was basically flat, and the peak season ushered in an inflection point in the market. At the same time, because the terminal market demand of tractor is still in the decline stage, the manufacturing industry is weak, and the industry inventory is gradually higher, which will bring great hidden troubles to the heavy truck market in the second half of the year. For the coming may, cvworld.cn predicts that positive growth in this month's heavy truck market sales will be difficult to achieve. At the same time, as all vehicle manufacturers and suppliers are focusing on seizing the market in the first half of this year, the trend of "sales in the second half of the year being weaker than these in the first half" will be obvious in 2019 (similar to the development trend of heavy truck market last year).