Data Analysis | Heavy Truck Market Development Perspective

Analysis of the reasons for the heavy truck sales and a slight increase in February 2019

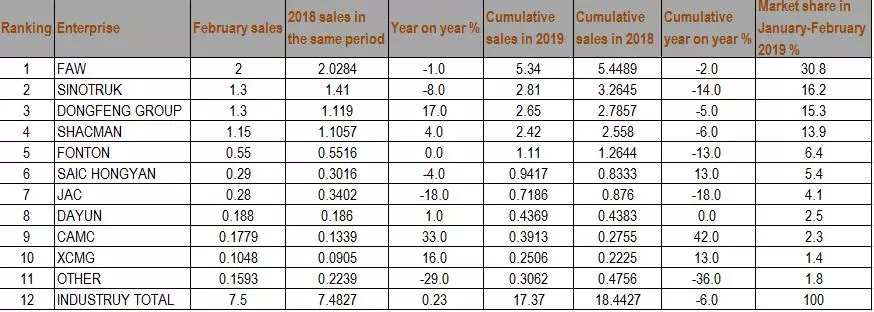

1. From January to February 2019, the cumulative sales of heavy trucks reached 173,700 units, down 6% from 184,400 units in the same period of last year.

2. In February, the industry's first place was still the familiar face, FAW, which sold 20,000 heavy trucks in the same month, basically was flat with last year; In January and February, the cumulative sales of heavy trucks totaled 53,400 units, down 2% year-on-year, and the market share reached 30.8%.

3. Sinotruk sold about 13,000 heavy trucks in February, with a cumulative sales of 28,100 units in January and February, down 14% year-on-year, with a market share of 16.2%, temporarily retaining the second place in the industry.

4. Dongfeng Heavy Truck sold 13,000 vehicles in February, with a cumulative sales of 26,500 vehicles in January and February, down 5% year-on-year, with a market share of 15.3%, ranking the top three in the industry.

5. Shacman Group, which ranks fourth in the rankings, sold about 115,000 heavy trucks in February, up 4% year-on-year. The cumulative sales in January and February were 24,200 units, down 6% year-on-year and the market share was 13.9%.

6. In February, Foton Motor sold about 5,500 heavy-duty trucks, with a cumulative sales of 111,000 in January and February. The market share was 6.4%, and it regained the fifth place in the industry.

7. In February, among the top 10 brands, 4 brands had negative year-on-year growth and 6 brands were growing or flat. In January and February, 6 brands were growing year-on-year, and 4 brands had a negative year-on-year increase.

In February, it grew slightly compared with the same period of the previous year. According to market research, the main reasons are:

The impetus of projects

The recent intensive announcement of state and local fixed asset investment has driven demand for new vehicles in the construction machinery and heavy truck markets. In particular, the segment of the engineering vehicle segment has been driven by the demand for downstream terminals. Especially since the end of February, infrastructure projects in some areas have entered the start-up phase, and end-customer demands and orders have been coming.

Sufficient stocking

Many of the sales in February were already stocked by heavy truck companies and dealers. The inventory level of the whole industry was at a high level. On the one hand, this aspect is fully prepared for the arrival of the peak season after the Spring Festival, so as not to be caught off guard when the terminal customers’ orders arrive and give the customers to other rivals. On the other hand, it also reflects that OEMs and dealers are expecting a good start in the traditional peak season of the heavy truck market, and they are generally optimistic.

Spring Festival influence

The large demand for food in the Spring Festival has driven the segmentation of the logistics market, especially in the heavy-duty truck market for long-distance transportation.

Marketing promotion

At the beginning of the year, various heavy truck companies attended the annual meeting and marketing promotion meeting, and also received a lot of orders.

Analysis of the development trend of the heavy truck market

According to market research, combined with the analysis of Roland Berger, an internationally renowned consulting firm, the development trend of China's heavy truck market is as below:

New products are developing towards high horsepower. In recent years, in the heavy-duty truck market, the sales proportion of high-powered vehicles continued to rise, and the new high-powered heavy-duty trucks of various brands, especially those with more than 500 horsepower and more, the engine manufacturers even launched new products with 600-650 horsepower. It can be seen that the large horsepower heavy truck has become a market trend.

Intelligentization

In recent years, the trend of Intelligentization of heavy trucks has become obvious, and it can be said that it is getting fiercer. At the end of 2018, four heavy truck companies exhibited smart trucks. Take FAW J7 heavy truck as an example, the FAW J7 smart truck was tested on the expressway in Changchun on October 6, 2017. It has five smart functions: signal recognition, obstacle recognition, overtaking, following, and remote control. It can not only effectively solve the fatigue driving problem, but also save the labor cost. The FAW J7 smart truck will have better performance in 2019.

New products have increased

In the past two years, although there were more and more heavy trucks, most of them were improved versions of mature models, and there were not many new types of models. At the 2018 annual meeting, companies such as FAW and Shacman Auto exhibited their respective new products, FAW J7 and Delong 6000 series. A new generation of FAW heavy-duty truck - J7 has not made many upgrades in powertrains, and has followed the mature powertrain technology to ensure price and product reliability. From the perspective of the materials and assembly process of the spare parts, the FAW of the J7 will be further improved, and the final product quality will be very different from that of the J6. The interior workmanship and space layout are also an obvious upgrade, especially in the current sleeper. On the basis of the launch of the flat floor cab, it can be said to be very attractive.

The use of new energy

The potential of China's new energy truck market will be further released. Light trucks will be dominated by pure electricity, and medium-heavy trucks will have a high proportion of hybrids. With the advantages of green environmental protection and longer battery life, the application prospects of fuel cells in heavy truck road transportation are promising.

Product upgrades

China's heavy truck market is still dominated by low-cost vehicles, but the future market structure changes are driven by demand and supply, and the trend of high-end is significant. It is estimated that by 2025, the proportion of vehicles with a unit price of more than 400,000 will reach 40 %. Commercial vehicle systems such as braking, steering, and smart driving have begun to upgrade their technology. Driven by regulations, comfort and safety requirements and high-end products, emerging technologies such as disc brakes, semi-automatic transmissions and smart driving will accelerate penetration in the next decade.

Customer concentration increase

The concentration of industry important customers continues to increase, transportation efficiency increases, and platform customers are rapidly emerging. Among them, the improvement of logistics efficiency has promoted significant changes in the structure of heavy truck users, and fleet customers are more likely to achieve longer operating hours and higher turnover efficiency; the proportion of future fleets and corporate customers will increase significantly, and the cost of car ownership and after-sales service will have higher requirements; centralized customers are increasingly concerned about the TCO (total cost of ownership) of the product and the integrated sales solution when the product is purchased; the emergence of the distribution platform has subverted the traditional distribution value chain, which has greatly squeezed the living space of intermediaries, and the operational efficiency and driver income have been effectively improved.

Personalization and customization are outstanding

The emergence of the new generation of heavy-duty truck consumer groups and the customization trend of market segment products require the OEM to pay more attention to the individual needs of users. From the customer's point of view, each industry has a clear preference for heavy-duty vehicle categories, and corresponding market segment customers will have customized requirements for heavy-duty truck products. The segmentation growth of different customers will also drive the refined iterative upgrade of heavy truck categories.

Internet upgrade

User-centric guidelines will drive automakers to adopt more aggressive and innovative models to achieve an experience upgrade for potential customers and owners.

Product segmentation

Domestic heavy truck sales have fluctuated widely, especially for tractors and dump trucks, while sales in trucks and special vehicles have been relatively stable. In order to maintain a leading position in the heavy truck industry, companies are required to have a more balanced sales structure.

The post-market business segment

The value chain extends. The focus of the domestic auto industry's profit is still mainly concentrated in the front end of the industry chain. In the future, in response to changing trends, heavy-duty truck companies will quickly reduce their reliance on traditional businesses and gradually extend from parts sales and financial services to emerging new energy and post-market ecosystems.