Analyses of the heavy truck market from January to May in 2018 (Part Two)

In May of this year, the top ten heavy truck companies sold 110,900 vehicles totally, accounting for 97.3% of the total heavy truck sales volumes. The sales volumes of these nine companies was increased differently. Five companies sold over 10,000 vehicles. FAW Jiefang sold 23,500 trucks. Dongfeng sold 22,000 trucks, ranking the second in the industry, and Dongfeng’s sales volume is 1,500 less than that of FAW Jiefang. China National Heavy Duty Truck Group sold 18,500 trucks and Shanxi Automobile Group Co., Ltd sold 16,500 trucks, ranking the third and fourth in the industry.

In May, the fastest year-on-year growth was Hongyan, which was increased by 68% (compared with its sales volumes in April); XCMG Heavy Trucks ranked the second, and its year-on-year growth was increased by 62%. Foton remained the rapid growth since March of this year and sold 13,000 vehicles in May. The year-on-year growth of May was increased by 46%, which was increased by 30% compared with April, ranking the top three in the industry. The cumulative growth rate of Foton Heavy Trucks was also increased, which was basically equal to the overall growth rate of the industry.

From January to May this year, the heavy-duty truck market sold 560,200 vehicles in total, which was increased by 15% compared with the sales volumes in the same period of last year. Eight companies have seen positive growth among the top ten companies. The growth of Hongyan was the fastest, reaching 79%, followed by XCMG, with an accumulative increase of 42%. The third fastest growth was FAW, and its year-on-year increased 25% from January to May.

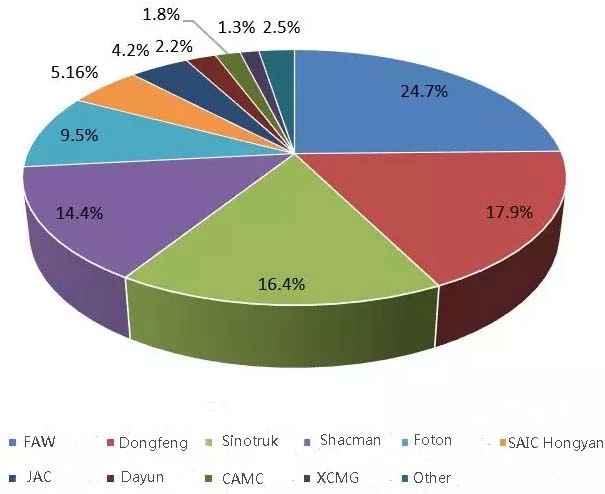

The heavy truck market share from January to May 2018

From January to May this year, the top six heavy truck companies were: FAW (138,300 trucks), Dongfeng Group (100,2 00 trucks), Sinotruk (91,700 trucks), Shanxi Automobile Group Co., Ltd. (80,600 trucks), Foton (53,000 trucks) and Hongyan (28,900 trucks). The six companies sold a total of 498,700 vehicles, which accounted for 87.96% of the 560,200 heavy trucks sold from January to May. In addition, the market share of the top eight companies including JAC and Dayun was 94.35%, which was reduced by 0.24 compared with the sales volume in the same period of last year.

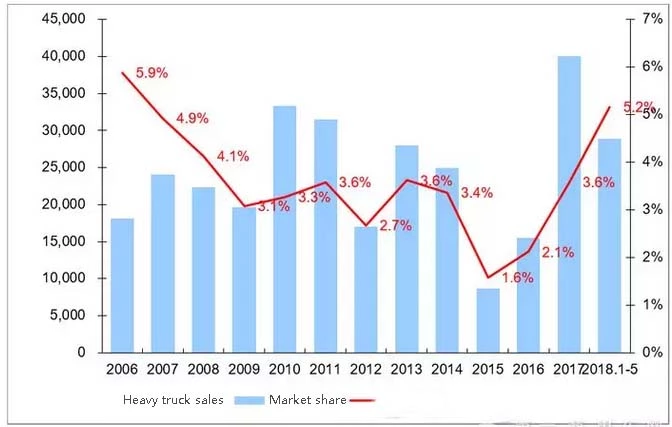

It is worth mentioning that Hongyan has the fastest growth among the top ten heavy truck companies from January to May, and its growth rate reaches 79%. Hongyan has experienced a rapid growth since it belongs to SAIC Motor. The year-on-year growth increased 158% in 2017 and its monthly sales growth also increased. The year-on-year growth was 194% in January, and it increased 50% in February, 66% in March and 68% in April and May. We can see from the following chart that the market share has been climbing all the way, reaching 5.2% from January to May in 2018 since the market share of the old brand Hongyan reached its bottom in 2015, moving forward to the highest market share in the previous year of its joint venture ( 5.9%). According to the annual goal set by SAIC Motor and Hongyan at the beginning of the year, Hongyan needs to reach a market share of 6% in 2018, creating a historical new record in the market share.

Hongyan's sales volumes and market share chart for the past 13 years

May has passed. What people are most concerned about, of course, the performance of the market in June and the coming July. Will the heavy-duty truck market continue to grow in June? When will the inflection point of decline occur? Can one million trucks be realized?

In this anxious process, at least one thing that can be determined is that sales volumes in 2018 will break through one million, which is a high-probability event. In July this year, it is likely to be the turning point of the industry's decline.