Analyses of the heavy truck market from January to May in 2018 (Part One)

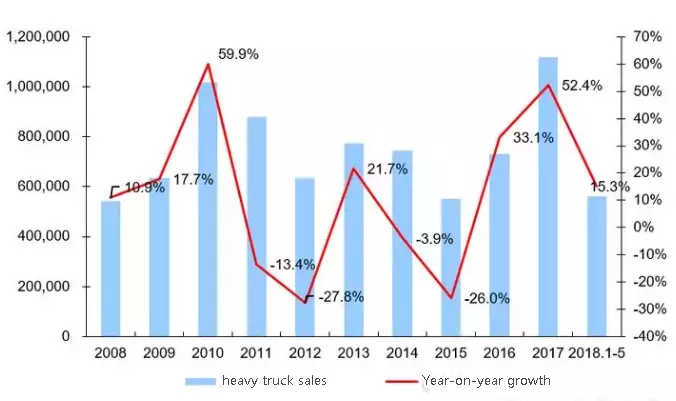

Annual Chart of the Heavy Truck Market from 2008 to 2018

According to the data, the sales volume of the heavy truck market continues to exceed expectations, because investment in fixed assets in infrastructure across the country is constantly increased in May of 2018. The competition situation of the heavy-duty truck industry can be described as follows.

- Sales volumes of Foton and Hongyan are successively good.

- XCMG always ranks the top ten.

- The market concentration slowly increases.

- Small businesses still have opportunities to break through.

In May 2018, China's heavy-duty truck market sold approximately 114,000 vehicles with various types, which is increased by 17% compared with the same period last year. In May 2017, China's heavy-duty truck market sold approximately 97,700 vehicles. This is also the fourth time that the heavy truck market has broken monthly sales volumes after the sales volumes in the heavy truck market set a new record in January, March and April this year. Before May of this year, the highest sales volumes in the history was May of 2010, that was 107,000.

The main reasons for the rapid growth of the heavy truck market in May and the first four months of this year are as the following.

- The sales volume of the heavy duty truck market in last year is transferred to this year.

- The truck dealer stocks a lot of trucks, which will bring a hidden danger for the truck market in the next half year.

- The monthly growth rate of infrastructure investment in fixed assets continues to exceed expectations, making the market performance of heavy duty vehicles for construction continue to exceed expectations.

- The car carrier which is not qualified was forbidden to be used since July 1, which stimulated the car carrier market in the first half year.

- The limitation of the diesel vehicle which reaches National III emission standard brings benefits for buying new heavy trucks.

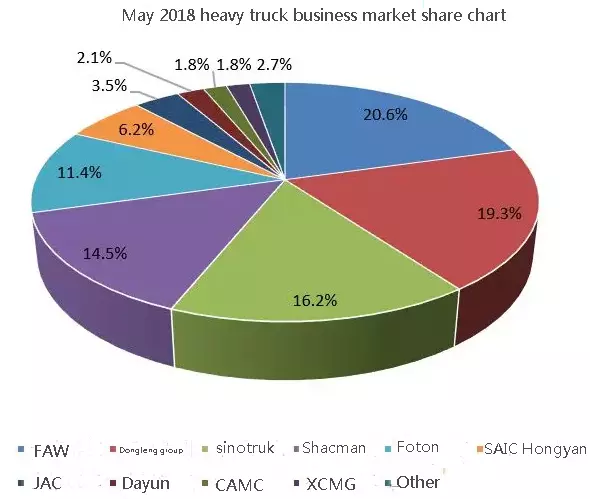

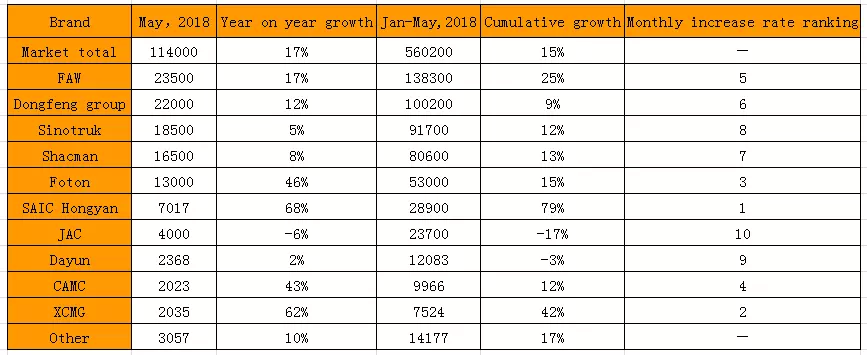

In May of this year, the top six sales volume of domestic heavy truck companies are FAW (23,500 heavy duty trucks), Dongfeng Group (22,000 heavy duty trucks), China National Heavy Duty Truck Group (18,500 heavy duty trucks), Shanxi Automobile Group Co., Ltd. (16,500 heavy duty trucks), Foton (13,000 heavy duty trucks) and Hongyan (7017 heavy duty trucks). The six truck companies sold about 105,000 vehicles totally, accounting for 88.17% of the total sales volume in May, that is, 114,000 heavy trucks. It is increased by 0.47 compared with the same period last year. The market share of the top eight truck companies including JAC and Dayun is 93.76%, which is reduced by 0.68 compared with the same period of last year.